Where do Web3 VCs invest during the bear market: Q1’23 overview

By the beginning of 2023, the total crypto market cap plummeted to approximately $750B, although just a year earlier it accounted for over $2.2T. There are a lot of reasons behind this, including historic collapses of numerous crypto enterprises, like FTX, Alameda Research, Terra, Celsius, Voyager Digital, and Three Arrows Capital, resulting in huge losses for all sorts of investors, both institutional and retail. This crisis also urged governments to watch the crypto industry more closely and develop a regulatory basis for the participants.

In these stormy conditions, many investors curbed their appetite for high-risk crypto and Web3 investments. As a result, the total blockchain and crypto funding volume dropped to $3.7B in the last quarter of 2022, which was the lowest rate since the beginning of the latest crypto bull run. Though, some sources, like DefiLlama, argue that the funding volume in the final quarter of 2022 was even lower.

But despite the economic challenges and instability, some crypto VCs, and, of course, Web3 founders are ready for the long run to support their beloved projects and technologies. And the main aim of this article is to figure out the main changes in the investment landscape in the beginning of 2023, amidst the uncertain environment and crypto price fluctuations, with a specific focus on Web3 projects and gaming.

VC funding in Q1’23

At the time of writing this article (at the end of March 2023), the first quarter of the year isn’t over. For this reason, most popular analytic services haven’t yet published their reviews. However, some companies have already made the first attempts to assess the state of VC funding in the beginning of 2023.

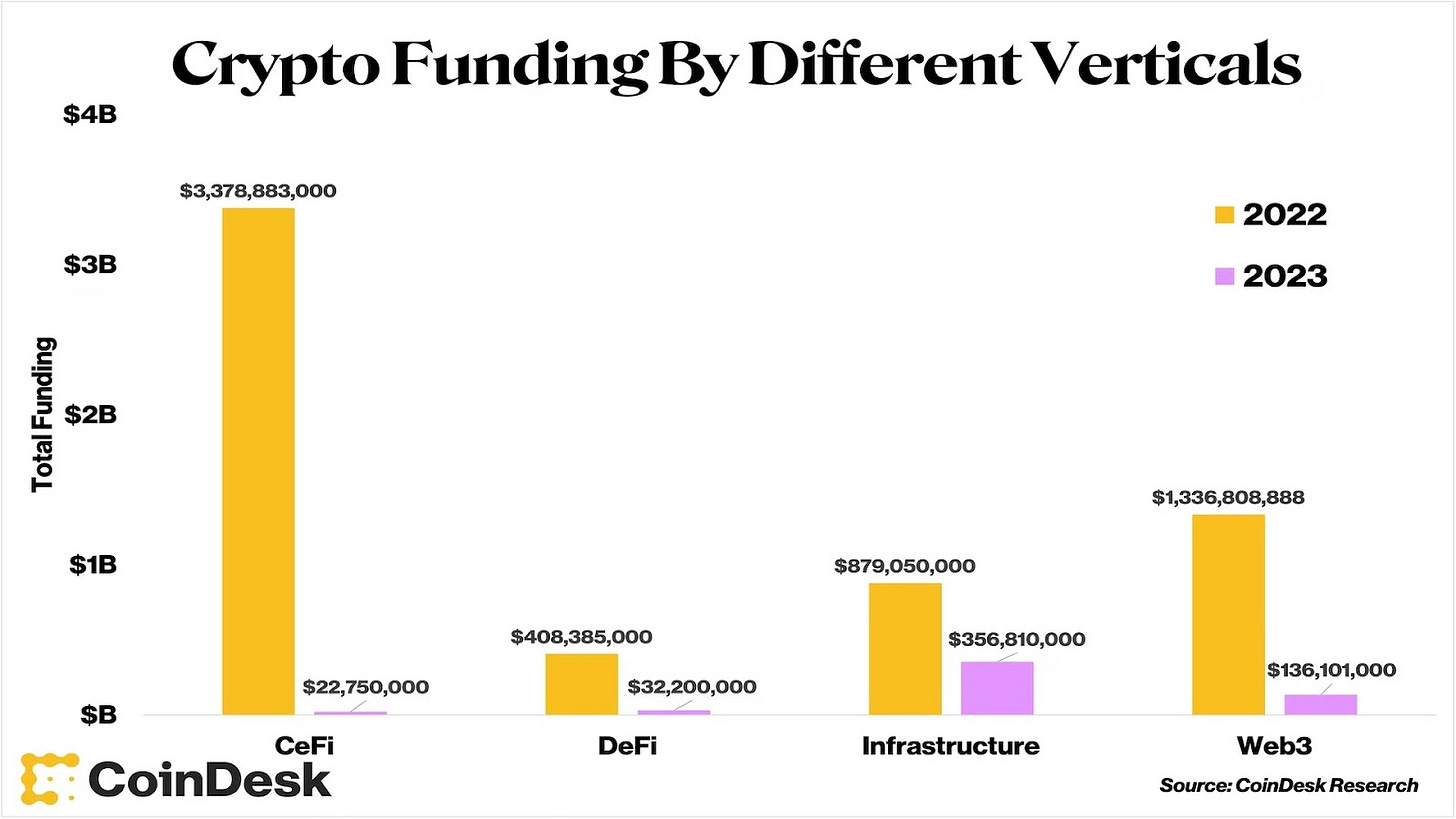

As an example, in February, Coindesk announced that the “crypto winter” led to a 91% plunge in January 2023 compared to the same period last year. According to their estimates, the total funding in the crypto industry accounted for $548M. At the same time, CeFi was the least invested and the most sensitive vertical, while infrastructure and Web3 projects received more investments.

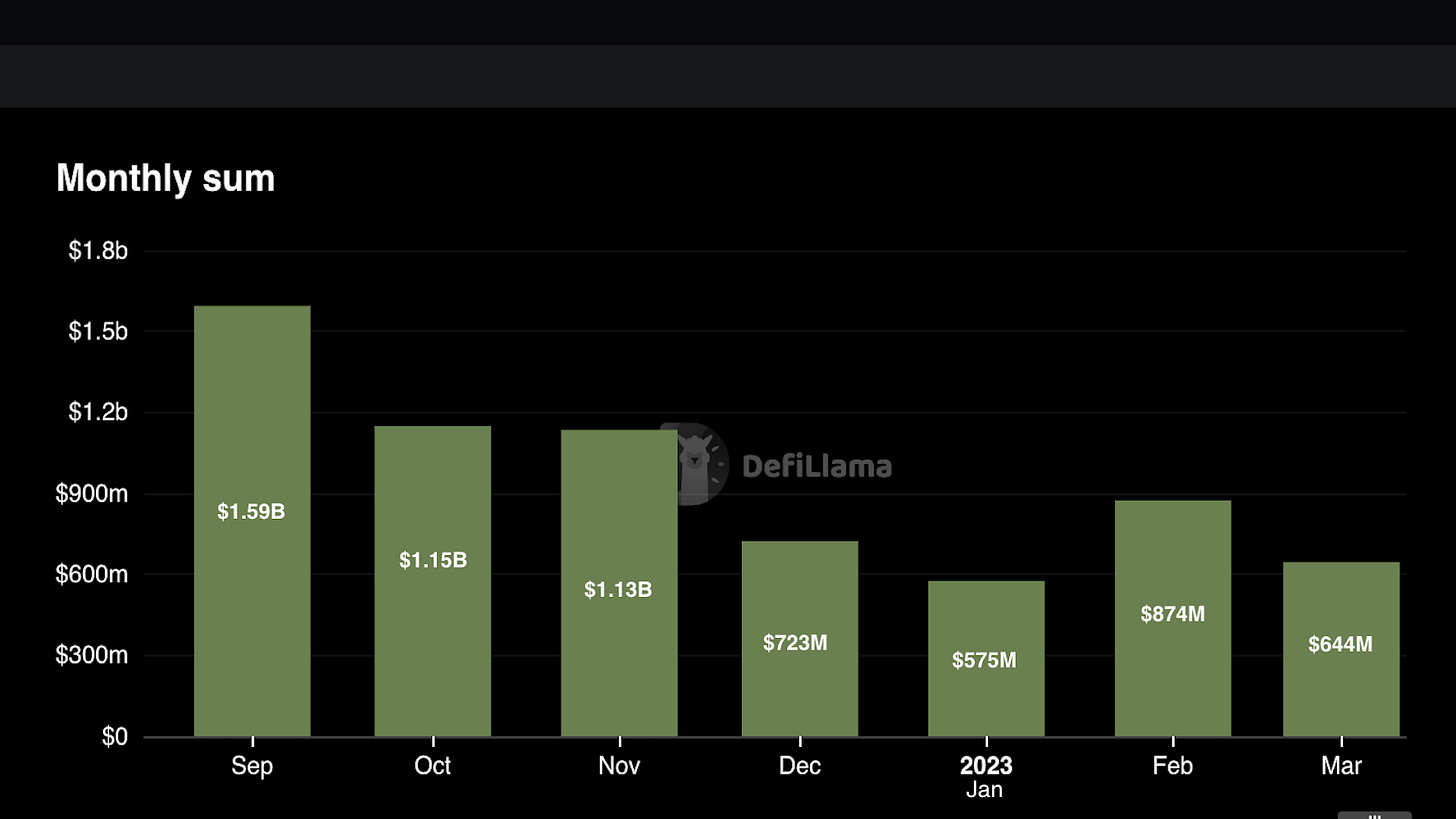

DefiLlama shows almost the same information for the first month of 2023 — $575M in total funding. At the same time, the platform indicates an increase in investments in February and March.

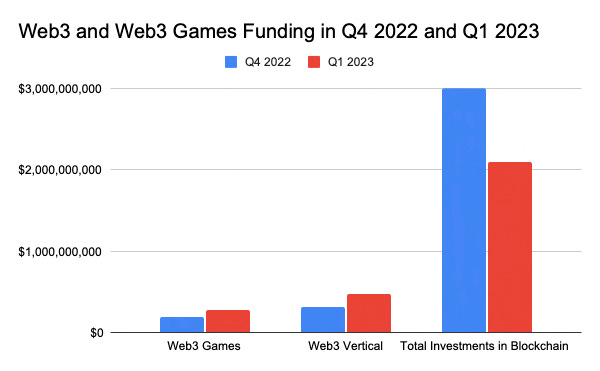

According to DefiLlama, the total funding volume in the blockchain industry will most likely account for $2,1B in the first quarter of 2023. Thus, we will see a 40% decline over the last quarter of 2022 which had $3B in the total funding volume. That said, we have to keep in mind that the quarter isn’t over yet, therefore, we will see the precise results later.

Despite the quarter-on-quarter drop in total investments in the blockchain industry, the funding volume in the Web3 vertical, including Web3 gaming, increased almost by 50% in the first quarter of 2023 and accounted for $476M and $279M respectively. In the last quarter of 2022 the investments in Web3 and gaming reached $317M and $184M respectively. It has to be clarified that we have included companies building NFT solutions, metaverses, games, social media, and other Web3 products in the Web3 vertical.

Some remarkable deals in Web3 space

In this section, we will try to highlight some of the most outstanding investment deals in the Web3 space in Q1 '23. Please note that the list below is not exhaustive at all. It doesn’t represent any kind of rating or ranking. But I believe that they may significantly influence the industry and boost the mass adoption of new technologies.

Redeem

Pre-Seed Round for $2.5M, 03.21.2023

Investors: Kinetic Capital (lead), Monochrome Capital, VC3 DAO, The Fund, Flyover Capital, CMT Digital, KCRise, KESTREL 0x1.

Redeem is developing a breakthrough technology that will allow users to send and redeem NFTs via phone number. Users will be able to link any crypto wallet on any blockchain to receive utility NFTs, like game assets, tickets, membership or loyalty cards. At the same time, the users won’t require any specific knowledge to utilize new Web3 technologies. Redeem will also allow to exchange NFTs through popular messaging services, like iMessage, WhatsApp, or SMS, without complicated crypto interfaces or gas fees.

After the launch scheduled for the second half of 2023, the Redeem protocol may boost the adoption of the blockchain technologies by onboarding mainstream business, retailers, or event organizers. The startup also has a strong team behind with Toby Rush, a former Alibaba executive, and Kenny Conklin III, a veteran blockchain executive.

Curio

Seed round, $2.9M, 02.21.2023

Investors: Bain Capital Crypto (lead), TCG, Formless Capital, Smrti Labs, Robot Ventures.

Curio is a Web3 platform focused on building truly on-chain games. If you are new to this emerging Web3 gaming technology, feel free to read more about it in one of our previous articles.

The startup plans to build new games with user-generated logic and take the user-generated content to the next level. Gamers will be able to establish rules, create assets, and interact through smart contracts.

Curio has already launched one game, Treaty, allowing players to govern the nation by deploying smart contracts. Players have to allocate resources, explore new lands, and choose allies. At the same time, this game features improved graphics, if we compare it with the early examples like Dark Forest.

On top of that, at the moment Curio is developing another game which looks even more fascinating. The startup is also building a native infrastructure to make on-chain games more accessible for mainstream users. We believe that on-chain gaming is one of the most exciting implementations of blockchain technologies, that is why we have included this Web3 studio in our list.

Yield Guild Games

Strategic investment (token purchase), $13.8M, 02.17.2023

Investors: DWF Labs (lead), a16z crypto, Galaxy Interactive, Sangha Capital Fund, Sanctor Capital, David LEE Kuo Chuen.

Yield Guild Games is one of the most prominent Web3 DAOs whose role during the Axie Infinity craze in 2021 was well remembered by Web3 gamers. Last February, the guild received funding from the group of investors led by DWF Labs, an investment arm of Digital Wave Finance (DWF), a market maker for spot and derivative products in over 40 crypto exchanges.

Andrei Grachev, the managing partner of DWF Labs, highlighted that DWF Labs believes that “blockchain has the potential to transform the gaming industry by enabling players to own their own assets and earn rewards”. Through this investment, the company aims to help the guild expand its offerings, including Guild Advancement Program, to provide more opportunities for players in a decentralized gaming ecosystem.

Believer

Series A, $50M, 03.07.2023

Investors: Lightspeed Venture Partners, a16z, Bitkraft Ventures, Riot Games, The Tornante Company.

Believer is a new studio which aims to chart a path for developing new kinds of games at the crossroads of classic concepts and powerful innovations, like AI, blockchain, and Web3. The startup aims to become Pixar in the gaming industry by devising original approaches and standards.

At this point, Believer didn’t share any specific plan of releases, and its Chief Product Officer, Steven Snow, said that most probably the new company wouldn’t launch anything in the upcoming three or five years. At the same time, the startup has already made first impressive steps by hiring the top industry veterans, including Landon McDowell as CTO (Microsoft, Riot Games, Linden Lab), Jeremy Vanhoozer as CCO (Bungie, Electronic Arts), Tim Hsu as COO (Twitter, Riot Games), Shankar Gupta-Harrison as CMO (Riot Games, Dentsu X), and many others.

Superplastic

Series A-4, $20M, 02.15.2023

Investors: Alexa Fund (lead), Google Ventures, Galaxy Digital, Sony Japan, Animoca Brands, Craft Ventures.

A venture capital arm of Amazon, Alexa Fund, has led a $20M funding round for Superplastic, an animation studio behind amusing cartoon characters Janky and Guggimon. These “synthetic” celebrities are social media influencers also featured in various NFT collections.

As such, Amazon is interested in developing a brand-new type of intellectual property which combines Web2 and Web3 elements. The сompany is also working on a TV show with these virtual celebrities.

Remarkable funding rounds for Web3 games

As mentioned above, the first quarter of 2023 recorded a significant increase in funding for Web3 games. Thus, it wasn’t easy at all to select the deals below because of the huge number of top gaming projects, like Worldwide Webb, Bravo Ready, and many others. For this reason, I’ve picked the most impressive deals that may influence the further industry development by setting new standards.

EVE Online (CCP Games)

Seed, $40M, 03.21.2023

Investors: a16z (lead), Makers Fund, BITKRAFT Ventures, Kingsway Capital, Hashed, Nexon.

CCP Games, the studio behind EVE Online, is planning to use the funding received from some of the most prominent VCs to develop a full-fledged blockchain AAA title within the existing universe. Eve Online is a space MMORPG launched 20 years ago which allows gamers to participate in various activities, like mining, trading, piracy, exploration, etc. The game once featured one of the most populous battles in the history of online gaming which lasted for 21 hours and involved more than 7.5K gamers. CCP Games plans to implement blockchain solutions to develop new ways of interaction between players and game ecosystem.

Source: Eurogamer.net

Azra Games

Seed+, $10M, 02.23.2023

Investors: a16z crypto (lead)

Azra Games received another $10M on top of the previous $15M funding for a new Web3 sci-fi game, Legion and Legends. Mark Otero, who now leads Azra games, was previously in charge of developing EA's Star Wars: Galaxy of Heroes, a mobile game which has generated around $1B in revenue.

Mark Otero highlights that Azra Games aims to create immersive game universes with developed economy and virtual collectibles powered by Web3 technologies, like NFTs. Unfortunately, we couldn’t find any specific release date but discovered some pre-alpha screenshots on Twitter.

Jungle

Seed, $6M, 03.14.2023

Investors: Bitkraft VC & Framework Ventures (lead), Delphi Digital, 32-bit Ventures, 4RC, Bodhi Ventures, Karatage, and other investment firms.

Jungle is a new Brazilian publisher at the forefront of the Web3 gaming revolution, seeking to develop blockchain games to onboard the next generation of players. Though the team doesn’t have any games in the portfolio at the moment, and the first Web3 shooter is scheduled for the end of 2023, the investment firms involved in the deal noted that they aim to grow the presence in the LATAM region full of avid gamers.

Bottom line

At this point, we do not have access to the quarter analytics from the industry leaders simply because the quarter is not over. But, most probably, we will see a further decline in total VC funding in the blockchain industry in Q1’2023. At the same time, the share of investments in Web3 startups and Web3 games will probably increase compared to the closing quarter of 2022.

It’s obvious that VCs are very cautious in allocating funds in these stormy conditions, but Web3 and GameFi probably represent a great opportunity for them due to the presence of mainstream brands, like Amazon and Eve Online, or because of the great teams behind the projects.

At the same time, it will probably take more time for investors to return to the sector after the recent upswing on crypto prices, so we hope to see a positive trend later this year.