How to get funding for your Web3 project

At a certain point, when your capital is insufficient to fuel your company's growth, you will need extra funding for further development. Just like traditional companies, Web3 projects are certainly not immune from these problems and sometimes need to look into fundraising to keep running. However, they can choose between conventional methods, like investment funds, or blockchain-specific models, like Web3 incubators and accelerators.

Crypto funding landscape in late 2022

You may think that late 2022 is not the best time for fundraising. And indeed, the blockchain and Web3 industry had a harsh 2022 with the LUNA crash and the FTX collapse. As a result, crypto venture funding dropped 35% in Q3 over Q2, from $9.5B to $6.2B. Traditional funds have changed their approach and reduced investments in blockchain and Web3 technologies; however, the crypto VCs remain active. Crypto trading and financial services took the most brutal hit: the investment flow in these segments shrunk more than two times in Q3 of 2022. At the same time, NFT/Gaming and enterprise blockchain segments are the leading fundraisers with the amount of funding slightly dropping in Q3 of 2022.

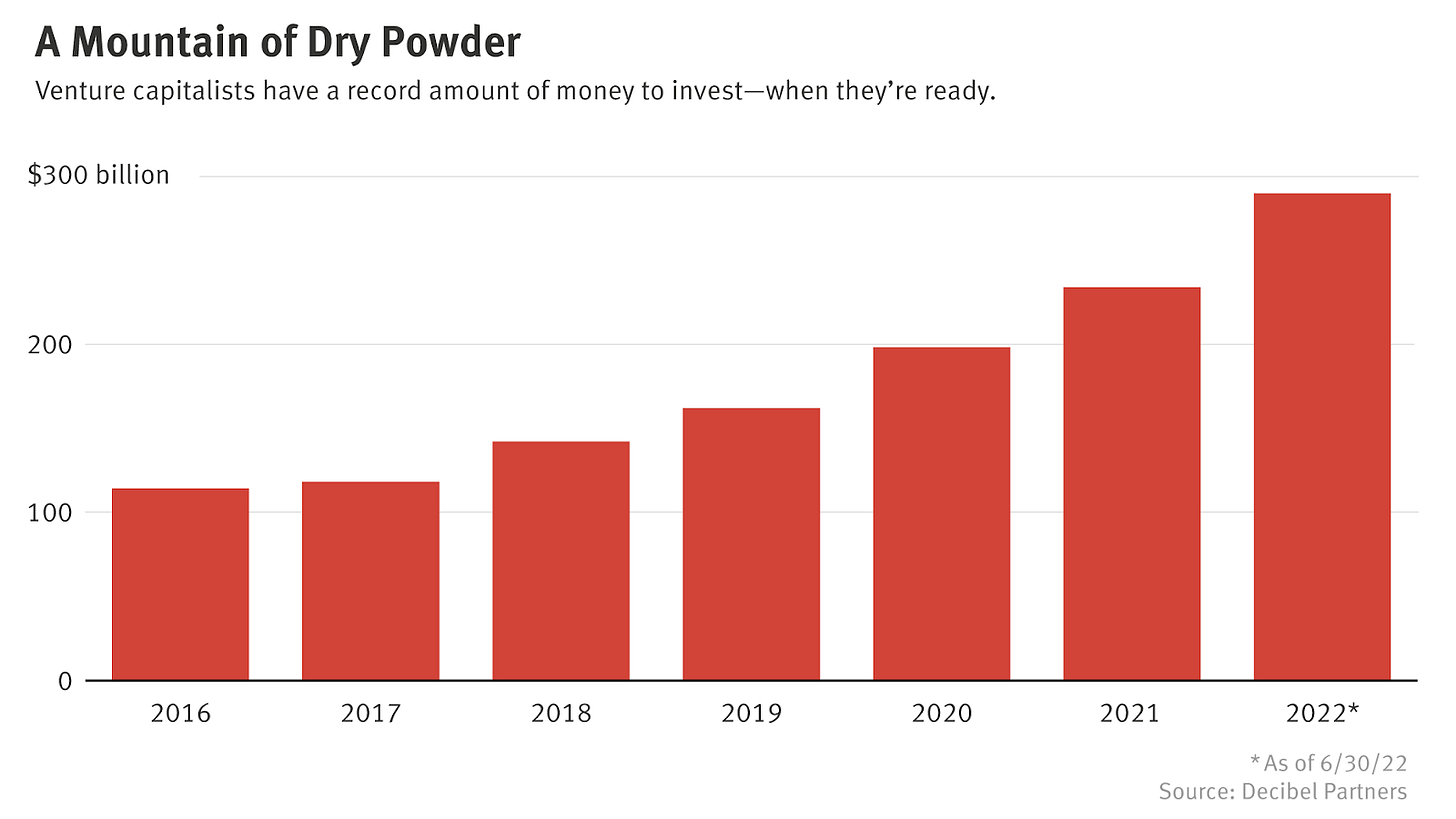

During the recent macroeconomic period, uncertain investors are more patient in deploying capital; however, we can see a record amount of “dry powder”, or idle funds, that will eventually be settled in new investment opportunities.

Web3 developers are more active than ever despite the dropping investor support and decreasing prices. The total number of verified smart-contracts on the Ethereum network has increased significantly and set a new all-time high.

Meanwhile, the Web3 gaming industry managed to raise $320M last November and remains the driving force of DApps with over 800K daily active wallets.

Digging deeper: investments rounds and series explained

Now, when you can see that even the bear market has room for fundraising, it is time to dive deeper into the details.

Funding is traditionally divided into a number of stages: pre-seed and seed stages, series A, B, C, etc. These stages define the status of your busines

s and its main goal at a particular period. More stages can be added later if the financial goals are not met, or when the founders are seeking additional support. It is worth mentioning that the structure and names of the series are arbitrary and have a lot of variations with no influence on rights and valuations.

These funding rounds and series provide an opportunity for involved parties to invest cash in emerging companies in exchange for equity or a partial ownership during the equity rounds, or in exchange for tokens during the token rounds. While tokens do not necessarily give direct legal rights or equity in the product or company that issued them, they can also have other functions unique to their native product.

Pre-seed round

At this stage, a startup team is just forming a business idea and evaluating if it can evolve into a living product. Funding here is mostly received from family or friends and does not require equity. You can also contact angel investors if you know the right people.

Seed round

At this point, the team is testing the viability of the product on marketplaces and analyzing market potential. In this funding round, you can raise capital from family and friends, incubators, angel investors, or VCs for product development and initial market entry.

Use tools like pitch decks and financial data including profit and loss statements, project roadmap, and more to convince investors that your product is sound and worth investing in.

Series A

This round is reserved for growing crypto companies with a validated product, a strong community, and a steady cash flow. The main goal here is convincing potential investors that you are running a business with long-term potential, meanwhile, they will look into relevant KPIs and metrics like initial revenue or user growth.

Typical investors for this round are VCs, but other profiles such as family offices, angels, and corporate venture arms may also join. You will probably get a number of investors aboard, and one of those will take the lead. For this reason, you have to select a truly supportive partner for the lifetime of your startup. Initial investors leaving the following startup funding rounds are seen as a bad sign.

Series B: early stage

Series B financing is all about growth. Investors need to understand your growth rate and the opportunities to further scale your business across the world. The funds can be used to develop your team in all the key directions (tech, sales, support, marketing, and more) for entering new markets, just for anything that helps to grow your business.

Now you have to choose your investors even more wisely since they are helping you to grow your business for entering the stock market and/or an attractive acquisition.

For that reason, many startups choose VCs as the best option for fueling aggressive growth.

Series C: expansion stage

If you are here, your startup probably has a great valuation and several years of overwhelming growth behind. This funding round is about optimizing the company by increasing the share of key markets, establishing it as the dominant player and acquiring startups, or hiring mature leaders to bring the company to the next level.

This stage demands a lot of funding, so you can expect long due diligence processes with lots of parties involved. However, there is a wide range of investors for you to deal with: VCs, large corporate investors, financial institutions, private equities, and hedge funds are eager to take part in these rounds.

The sources of blockchain startups funding

A few years ago, initial coin offerings, or ICOs, played the most important role in funding blockchain and Web projects, but since then the growing regulatory concern has changed the status quo. Although there are different funding sources for Web3 startups, like angel investors and blockchain-focused programs, in quantitative terms, venture capital plays the most important role in financing blockchain projects.

Investment funds and VCs

A venture capital fund, or VC, is a group of investors pooling their money and spreading bets on startups. In most cases, start-ups turn to VCs when they are not ready to go public. Before choosing to invest, fund managers carefully analyze and review the project's foundations, including its profit-loss statement, roadmap, founder bio, etc.

The rapid growth of blockchain and Web3 technologies has attracted the attention of traditional investors, especially, VCs. More than 3,300 funds invested in the crypto space since 2018, but only 339 of them had more than 10 deals since the beginning of 2021. Out of 339 active crypto funds, 190 investment bodies were active at early stages with a minimum of 10 pre-seed and seed investments.

There have been over 1,500 early-stage rounds (pre-seed and seed) in the industry since the beginning of 2021 with around $7.5B in total funds raised and an average round size of $3M. As you can see the early investment share in NFT and Web3 segments started growing rapidly in September 2021 and reached its peak in December 2021. This graph also shows that only about 20% of the companies that had received early-stage investments participated in follow-on rounds (Series A, B, C).

As a business owner, you have to understand the importance of choosing the right VC for your company. A fund looking for a short-term profit may quickly sell the equity or tokens and wreak havoc on your business, while an experienced long-term partner will lead you through rounds and introduce you to willing investors. The key to choosing the best investment fund for your project is evaluating its portfolio. A glimpse at the portfolio of an investment fund can help you figure out whether it would be interested in your project or not.

The advantages of VCs include trust from retail investors, solid relationships with key industry players, their experience, marketing, and operational support. VCs also require their investors to pass KYC, so you can feel protected from money laundering and do not need to think about collateral. However, you may face pressure for quick results, creative limitations, or excessive due diligence requirements.

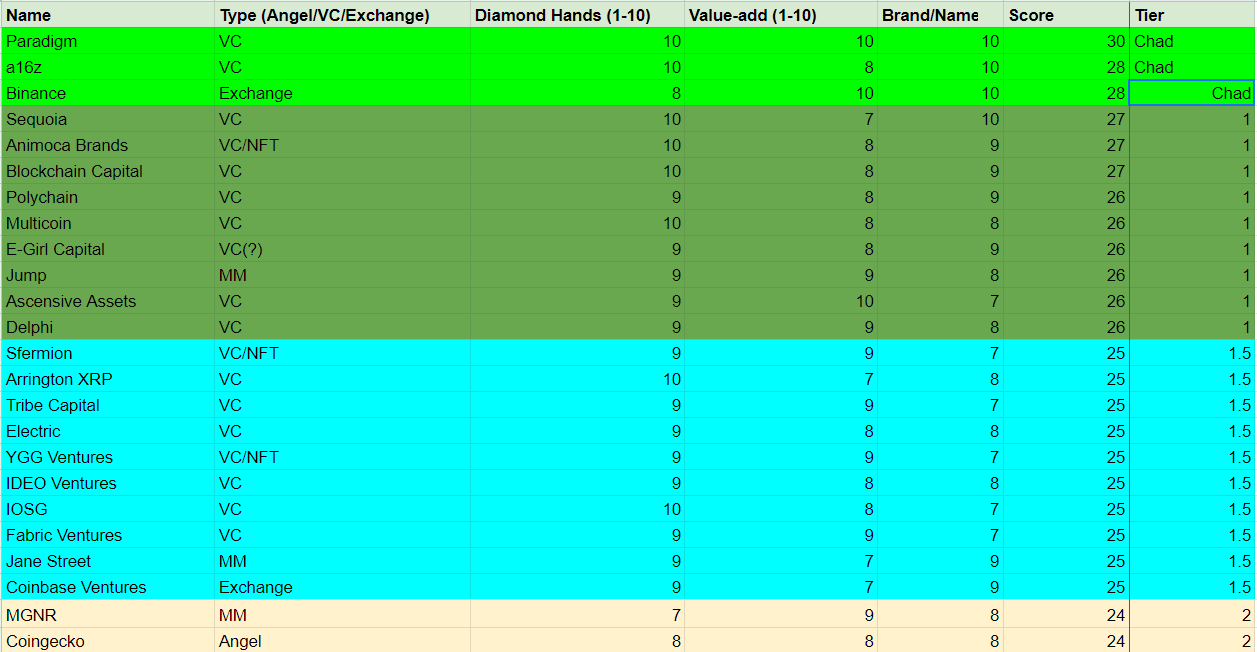

As we said earlier, there are lots of blockchain and crypto-oriented VCs with different offers and portfolios. Most of them have been ranked in this table. In this article, we will briefly cover just some notable names.

Andreessen Horowitz

Andreessen Horowitz, a.k.a. a16z, previously invested in Avalanche, Celo, Coinbase, MakerDAO, Matter Labs, Near, Opensea, Phantom, Uniswap, etc. a16z is also focused on investing in DeFi and gaming.

Binance Labs

Binance Labs manages projects from DeFi, NFT, and metaverse sectors. The fund’s portfolio includes brands like Stepn, AnySwap, Coin98, 1inch, BitTorrent, FTX, Polygon, Travala.com, etc.

Sequoia

Sequoia is an American VC fund operating in the US, Southeast Asia, India, China, Israel, and European countries. The company previously invested in Polygon, Animoca Brands, Magic Iden, Farway Games.

Digital Currency Group

Digital Currency Group is a New York-based investment company specializing in early-stage projects and matured businesses, previously invested in Big Time Studios, Decentraland, Horizon Blockchain Games, etc.

Coinbase Ventures

Coinbase Ventures, founded by Brian Armstrong, is the investing arm of Coinbase, a well-known CEX. Coinbase Ventures itself has been investing in projects like BlockFi, Compound, Starkware, and many others, contributing to building the ecosystem.

Polychain

Polychain is a VC from California, focusing on blockchain-based digital capital. Acala, Celo, and dYdX are just a few of the projects from the company’s portfolio.

Multicoin

Multicoin is a thesis-driven entity investing in cryptocurrencies, tokens, and blockchain companies. Being a crypto-only entity, it takes part in staking, liquidations, and other crypto activities. Audius, Arweave, and Near Protocol are the companies in its portfolio.

Angel investors

Reaching out to an angel investor is another option for an entrepreneur seeking extra funding. Generally speaking, an angel investor is a private investor providing financial backing for startups and entrepreneurs by using their own funds and usually in exchange for a share in business. As such, angel investors may be interested in projects with increased risks and rewarding opportunities. At the same time dealing with an angel is more flexible. There are different ways to find an angel investor, including professional websites and networking.

Incubators and Accelerators

Another opportunity to fuel the Web3 startup growth is finding a suitable incubator or accelerator program. The main advantage of these initiatives is that they do not solely focus on raising capital, but provide a range of other opportunities, including intros to involved investors. Incubators may become an ideal solution for startups at early stages, while accelerators can help startups build an effective structure for their future.

Seedify program

Despite the bear market, Seedify has almost doubled its division searching for high-level gaming projects. The program has already supported more than 50 blockchain game projects and consists of three stages:

Prelaunch support with market analysis, strategy, and tokenomics development.

Token launch and listing support.

Postlaunch support for incubated projects.

Use this link to apply for the program.

Binance Labs Incubation Program

The Binance Labs Incubation Program offers a biannual 8-week agenda addressing all the founder’s needs and supported by vast ecosystem resources. The entrants will get a chance to interact with market leaders and participate in an investment-focused demo day.

Binance Labs has recently selected 12 top-performing projects, including Harvest MOBA-game, for the 5 season of the incubation program, so keep following the Binance Labs channels to get the updates on the next season in time.

Icetea Labs

Icetea Labs previously partnered with Polygon and Alpha Venture DAO to develop a brand-new Web3 Accelerator Program with the main focus on GameFi, Metaverse, and NFT utilities.

Benefits for entrants include:

Access to knowledge, mentors, experts, and global investors in Web3 Business.

An entire ecosystem of Icetea Labs and its partners to support product development and lifecycle.

Funding opportunities on a demo day where startups can pitch to accredited VC investors, angels, entrepreneurs, mentors, and partners.

The team has already selected the first batch of entrants, including Victory Point, Yooldo | Trouble Punk, Gummys, Eternal Glory, and Hashbon Pass, but you can also keep an eye on the fund’s additional initiatives, like the recent ILAP Cyber Monday with total benefits of up to $100,000 for GameFi companies.

IOSG Kickstarter Program

The IOSG Kickstarter Program is designed to support Web3 and blockchain projects by direct investments, community building, business adoption, mentorship from industry experts, promotion, and matchmaking.

The program is focused on DeFi, ETH 2.0, Layer 2, Open Web, DAO, NFT, Web 3.0, Social Token, and other blockchain solutions. Roll, Mintgate, Aavegotchi, Solv, and other NFT and social projects have already enrolled in the IOSG Kickstarter Program.

Crypto Startup School by a16z

CSS is a 12-week accelerator run by a16z crypto. The entrants are getting access to mentorship from industry leaders and to the network of the fund’s potential customers, its advisors and investors. a16z crypto also invests $500,000 in every participating company, in exchange for 7% equity and certain standard rights. The list of CSS alumni includes Phantom wallet, Flashbots, Teller, to name a few ones.

The program is open for crypto enthusiasts developing or interested in developing a Web3 product. Thus, entrants do not have to have a living product. If you are not confident in learning a Web3 programming language (for example, Solidity), you can apply with a technical teammate. At the end of the program, at the demo day, participants will have to showcase their product to the investors and the crypto community.

The CSS Spring 2023 cohort with approximately 30 entrants has already been formed and terminates on May 26, 2023, but we recommend you to keep an eye on the accelerator’s news and updates.

Alliance DAO Accelerator

Alliance DAO, founded in March 2020 by CMT Digital, Cumberland DRW, Jump Capital, and CoinBase, aims to support the DeFi and gaming companies. According to the main page, the Alliance DAO goal is “grow Web3 to 1 billion users by 2025”. StepN, dYdX, Dodo, SZNS, Solv Protocol, Legends of Verani are just a few of the accelerator alumni.

The three-month program is absolutely remote and includes educational sessions and mentorship from top industry professionals (YGG, Axie Infinity, Uniswap, Polygon, and others).

The program offers an optional $250,000 investment with 2 investment tracks (for early and later stages). The application for the next cohort closes on January 16, 2023.

Game7 technology grants program

Game7 partners with BitDAO, Avalanche, Solana Foundation, Warner Music Group, and others. It aims to support Web3 gaming and Metaverse infrastructure by investing in tools and communities and hosting online and offline events.

Everyone contributing to the Web3 ecosystem (individual builders, companies, and DAOs) is welcome to apply for a grant from Game7. The funding is milestone-based and depends on the project's scope, maturity level, and business plan.

Game7 also provides return-free grants of $3,000 to new games developers to cope with the financial impacts of launching new projects. The recipients can use the funds for operating expenses, up to $1,000 per month, for three months.

BRINC accelerator

The BRINC accelerator program provides tailored solutions for IT-startups and invests in companies from six verticals: climate tech, education, enterprise SaaS, food technology, hardware and IoT, healthcare, and Web3.

The three-month extensive accelerator program includes funding, mentorship and education, networking, and other advantages. At the time of writing (December 2022), there are two options available for Web3 enterprises, including the ZK Advancer Blockchain and NFT program with a $250,000 investment ticket, and The Sandbox Metaverse Accelerator Program with $150,000 funding.

The list of alumni includes Ajuna Network, Artizen, CRAYONDAO, Game Vault, and many others.

Exchanges and Ecosystem Funds

The funds led by the top crypto exchanges and ecosystems may provide more opportunities for fundraising and seeking support from the industry leaders. The list below is not complete at all, so you can find more funds focused on a specific blockchain ecosystem.

Flow Ecosystem Fund

Flow has launched a $725M fund to boost innovation and growth in the blockchain’s ecosystem. The fund is backed by a16z, DCG, and other industry leaders and includes a number of opportunities: a $10M Dapper Studio Ecosystem Fund for NFT and gaming companies, grants for builders, and ecosystem investments. The projects utilizing the Flow blockchain can apply for support here.

Oasis Ecosystem Fund

The Oasis Ecosystem Fund with $325M capital, is backed by Pantera, Binance Labs, Jump Capital, and other top ecosystem players. The fund is designed to support NFT, gaming, data tokenization, and DeFi projects built on the Oasis blockchain. Gaming projects with on-chain MAUs above 500 or NFT Projects utilizing the Oasis privacy features can apply for support here.

OKX Ventures

OKX Ventures is a crypto exchange fund with initial capital of $100M focused on exploring and investing in promising projects with great potential, including Layer 2 solutions, popular blockchains ecosystems (Polkadot, Solana, Near, Polygon, Terra, and Avalanche), NFT, GameFi, and SocialFi applications. WAX, Gods Unchained, Arbitrium, and Realy Metaverse are just a few projects supported by the fund.

OKX Ventures also provides post-investment support, such as contacting potential customers and building partnerships, providing access to OKX products and services, developing plans and strategy, etc.

Huobi Ventures

Huobi Ventures is the global investment division of the exchange aimed to accelerate digital economy and blockchain technologies. The fund is focused on investing in innovative projects from all over the world. Currently its portfolio includes more than 120 companies, including immutable X, Highstreet Market, Era7, and many others.

Crypto.com Capital

Crypto.com Capital is investing in long-term partnerships with companies driving the development of Web3 and supporting the industry leaders across the ecosystem. The fund’s portfolio includes Debank, Magic Square, Cosmic Guild, Mines of Dalarnia, and many other companies. You can apply via this form.

Starting your fundraising journey

We suppose that you have done the homework, researched the available sources, and selected the most relevant options. Now it is time to approach your potential investors.

Be sure to draw up a compelling pitch deck and a whitepaper, prepare data analytics and social media reviews. A clear roadmap highlighting key milestones to your desired goal is another tool that will help potential investors understand your plan.

Consider these simple hints to prepare an outstanding and convincing pitch:

Research the market and explain how current data applies to your business plan, and be as open as possible.

Learn and remember your key metrics to have a clear vision, thus you will be able to explain what you are doing in just a handful of words.

Tell more about your product or service, describe your target audience, but be specific and avoid endlessly droning about all the available features and opportunities.

Explain your unique value proposition. Think about what makes your business unique and different from your competitors and other players in the industry. Highlight your unique features and show investors how they can benefit from them.

Introduce your team, tell investors how their background and achievements will contribute to your success. Show that your team knows the goal and how to achieve it.

Explain how exactly the business plan will generate revenue and how much profit you expect to see.

Practice your pitch and try to make it as smooth as possible. Anticipate questions and formulate persuasive answers.

Always keep in mind that all the points mentioned above are supposed to explain how you are going to make investors rich. Do not simply describe your product, plans, and competitive advantages, but tell investors how you are going to win! Remember that your audience will care about your pitch only if they understand that you can bring sufficient profit for them.

At the same time, do not try to overwhelm and bore your audience with data and figures. Be enthusiastic and try to capture the listeners’ attention with something unique and unforgettable. Tell them the story behind your startup, how you got this brilliant idea, or met your teammates. Focus on the parts of your business that truly inspire you. The passion for your work is almost impossible to fake, that is why it is very important.

It is also wise to take heed to good advice from the industry experts with a great track record in fundraising, like Sam Altman from OpenAi. Being an investor himself, Sam suggests a simple yet very logical approach to presenting a project with three steps:

Get intros to investors and reach them in parallel, not in series.

Tell investors how you make money for them: describe the company's mission, the product, your future vision, etc.

Create a competitive environment for potential investors to get the best terms.

It is also worth noting that there are other ‘non-conventional’ ways of fundraising, that include networking at the industry events and summits or building a trustworthy profile on social media platforms and reaching out to potential VCs and angels. Being proactive along with utilizing all the available resources and know-hows is the key for successful fundraising.

Conclusion

Despite a bearish 2022 with the LUNA and FTX crashes, crypto startups still have plenty of opportunities for fundraising. While traditional, non-crypto, institutions have changed their approach to the Web3 industry, crypto VCs remain active.

A variety of funds, blockchain incubators and accelerators are offering a ton of opportunities for projects at different stages, with a launched product or simply with an idea. However, you must pick up an offer wisely, as an investment body looking for short-term profit may endanger your business, while an experienced long-term investor will contribute to your prosperity.